- #EMAIL A NICE REMINDER ABOUT COMPENSATION OWED TO YOU HOW TO#

- #EMAIL A NICE REMINDER ABOUT COMPENSATION OWED TO YOU SOFTWARE#

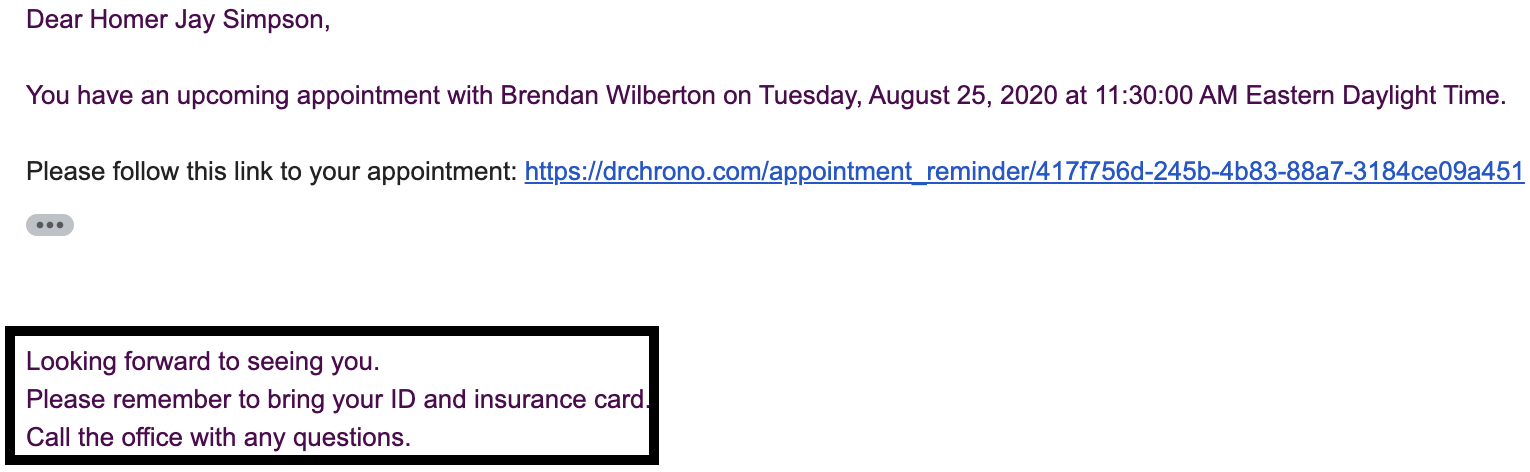

When you sign up for Chaser, 8 of our best-practise templates are pre-loaded onto your account and placeholder fields are automatically personalised for every recipient. would be replaced with your company’s name. Placeholders are within angle brackets “”, and signify where adapted text may go, e.g. Normal text is outside of brackets and stays the same across all reminders. In our experience, personalisation is key in making sure reminders don’t get ignored and invoices get paid! So, our templates are built from two parts: These templates can be copied and pasted directly into your emails, for you to send to customers.

#EMAIL A NICE REMINDER ABOUT COMPENSATION OWED TO YOU SOFTWARE#

You can access Chaser’s credit control software completely free for 14 days. Join thousands of businesses automating their credit control and getting invoices paid on time in less time, whilst maintaining great customer relationships.

#EMAIL A NICE REMINDER ABOUT COMPENSATION OWED TO YOU HOW TO#

So, these free templates demonstrate how to use emotional intelligence in your invoice chasing, and approach customers with kindness and diplomacy during these uncertain times. Particularly during these times of uncertainty, neglecting to appreciate the impact Covid-19 may have had on your customers’ business and their ability to pay in your email reminders will only lead to lower response rates - it is essential that you adapt your credit control to the current situation.Ĭhaser prides itself on using a human approach to invoice chasing.

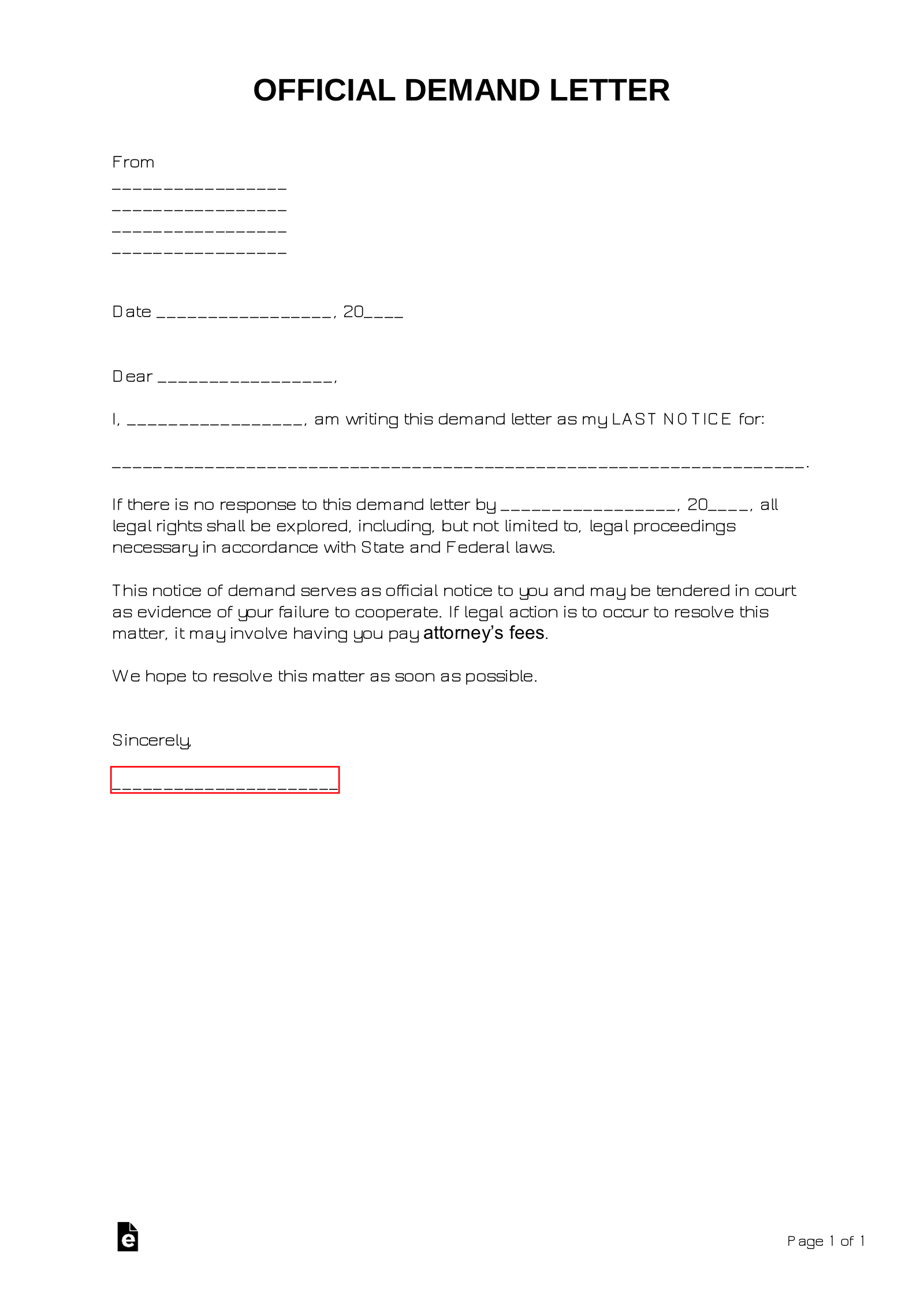

The essence is to give a chance to the recipient to settle the debt. Indicate a deadline – Each letter must have a deadline when the recipient should meet the instructions.Keep copies of the letters – Every time you sent a late payment letter to a client make sure you keep a copy of the letter.A hand signature will also imply professionalism on your part. Sign the letter – Since the letter can have legal implications, make sure you hand-sign the letter.Tom Tips for writing an overdue payment reminder letter We hope you’ll grant this matter the seriousness it deserves. And after 80 days we can’t proceed with business. Remember our contract states that all invoices must be serviced 30 days after receiving. The invoice in questions is invoice no……. Report the matter to I.R.S as “bad debt loss.”Ĭontact us so we can negotiate a favorable repayment plan.Hand over your case to our collection agent.We’ll have no choice but to take the following actions if you ignore this final letter. It essential to note you’re in a severe breach of contract.

We ask you to take immediate actions regarding your account and invoice number…… Despite several letters informing you of your overdue payment we have received no response so far.

The last section of the letter should include your name, designation, company, and contacts. Common phrases used include “Yours faithfully.” Cordially”, “Sincerely yours,” “Sincerely,” “Respected.” Footer Your payment reminder letter should end with a nice close. Use the other paragraphs to convey any other critical details about the debt.Įxpress hope for a speedy settlement of the debt as you end the letter. The first paragraph should contain the relevant details about the payment. The body of the payment reminder letter should comprise one to three paragraphs. After the title, if possible include the recipient’s name. Common greetings use in these sections includes dear sir/madam, Mr. Use the right salutation for the recipient. Recipient’s addressĪfter the date, the recipient’s address should follow. A date is an essential tool for reference. The date of writing the letter should appear after the letterhead. A company letterhead portrays professionalism, besides the recipient will know the origin of the letter once they receive it. If you have a company letterhead or logo, it should appear as the heading of the letter.

Overdue Payment Reminder Letter Format Heading Here, a sample or template can save your day. It’s difficult to get the right words to write the letter. The letter should be a request for payments. Though the payment is overdue, avoid forcing the individual/company to pay. The letter can act as court evidence you can also file the later for later reference. Though one can remind the client to settle the debt via phone or email, the best way to remind the debtor to pay the money is by writing a letter.

0 kommentar(er)

0 kommentar(er)